Explore Solar Panels on Installments in Pakistan

Solar energy is becoming more popular in Pakistan, but the upfront cost is still a hurdle for many people.

To make solar power more affordable, several banks now offer solar power loans that let you install a solar system on installments in Pakistan.

Most banks provide these loans at a 6% markup, as set by the State Bank of Pakistan.

With these financing options, you can spread the cost over time, making it easier to install solar panels for your home.

In this comprehensive guide, we’ll explore all the financing options and what things to keep in mind before finalizing a solar installment plan.

Before Choosing a Bank, What Factors Should You Consider?

As a Pakistani, you’ve likely had some experience with banks, whether you’re part of the upper or lower class.

However, when it comes to securing loans, things can get a bit confusing – and banks may not always be transparent about the options available to you.

That’s why it’s essential to understand the ins and outs of commercial bank financing in Pakistan.

So you should be asking these questions before making a deal:

- Is there any hidden cost associated with the solar loan?

- Is there any insurance plan?

- What are the terms and conditions of insurance?

- Does the loan cover all my costs, from solar panels to net metering?

How Much System Cost Increases With the Solar Loan?

Before taking a loan from any bank, it’s important to understand what you are getting and at what cost so that you do not end up losing out in the end.

As a rough estimate, you can expect monthly installments of a 3kw system between 18000 and 24000 Rupees for a 36-month period.

Most banks have a markup rate of 6% and also have insurance charges. Taking all these charges into account, the overall system cost increases by around 15-20% with solar financing.

Now, let’s look closer at the financing options of major banks in Pakistan.

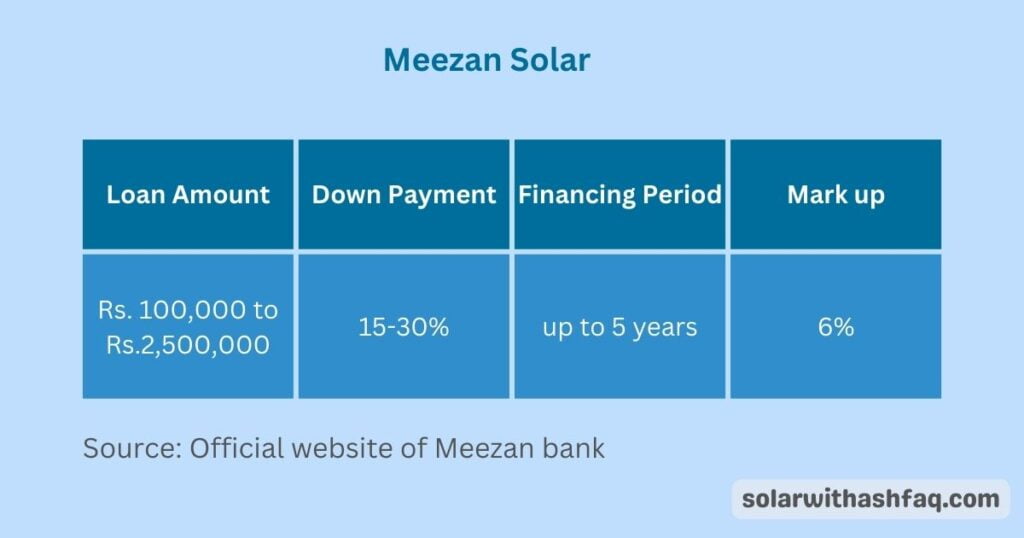

Meezan Bank Solar Financing

Meezan financing features

Meezan Bank is a leader in Islamic banking and offers Shariah-compliant financing solutions for solar energy with affordable processing fees.

This makes it easier for homes and businesses in Pakistan to obtain solar system installments.

Have a look at the key features.

Eligibility criteria:

(For Salaried Individual)

- You are working as a permanent employee

- Current employment for at least two continuous years

- Minimum monthly gross salary PKR 100,000

- Must be an active taxpayer with an NTN number

(For Self-Employed)

- You are in business/profession for a minimum of five (05) years

- Minimum monthly gross income PKR 500,000

- Must be an active taxpayer with an NTN number

How to apply?

- Open an account with Meezan bank

- Application form duly filled by applicant

- Obtain a quotation from a solar energy company partnered with Meezan bank

- Submit your copy of CNIC

- Submit the latest copy of your electricity bill

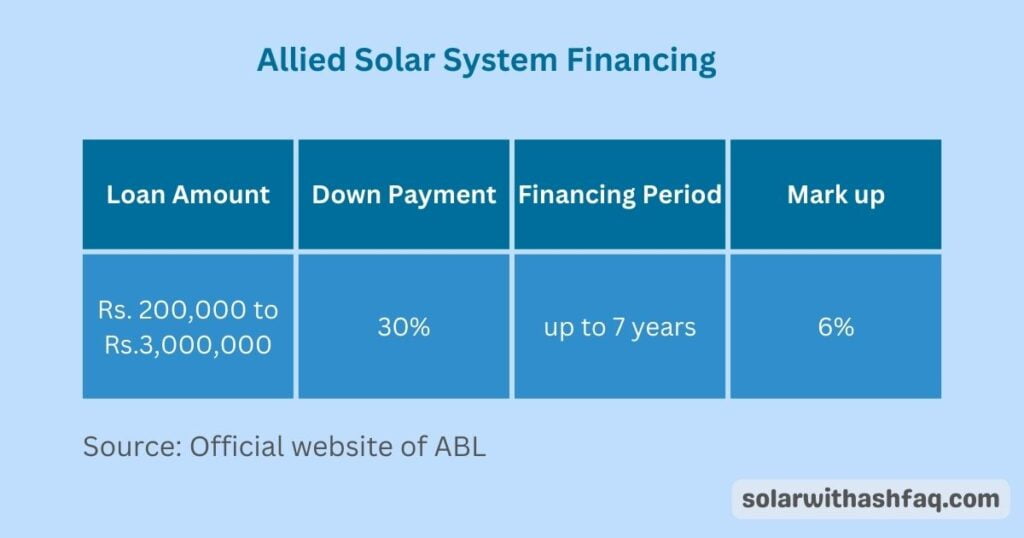

Allied Bank Solar Financing

Allied financing features

Allied Bank offers traditional solar financing options with flexible payment schedules, allowing homeowners to invest in producing their own solar power.

It gives easy installment plans with maximum financing tenure.

Here is the overview

Eligibility criteria:

(For Salaried Individual)

- You are working as a permanent employee

- You are employed for at least two years

- You have a minimum net salary of Rs. 50,000/-

(For Self-Employed)

- You are in business/profession for a minimum of two (02) years

- You have a minimum net monthly income of Rs.75,000/

How to apply?

- Open an account with Allied bank

- CNIC copy of the applicant

- Proof of property ownership

- Quotation with Survey Report from approved vendors

- Account Maintenance Letter, on a case-to-case basis

Alfalah Bank Solar Financing

Alfalah financing features

Alfalah bank is a trusted name in Pakistan in terms of customer service. Here is It’s financing scheme overview

Eligibility criteria:

- In the case of an employee, Your status should be permanent.

- Non-objection certificate from all owners in case of joint property

- The installment amount should not exceed 20-30% over and above the 3-month peak bill average

How to apply?

- Open an account with Alfalah bank

- Provide Income proof/bank statement

- Utility bills for the last one year

- Load applicability assigned by respective DISCO & Vendor survey report

You May Read: Average Cost of Solar Panel Systems in Pakistan [2024 Guide]

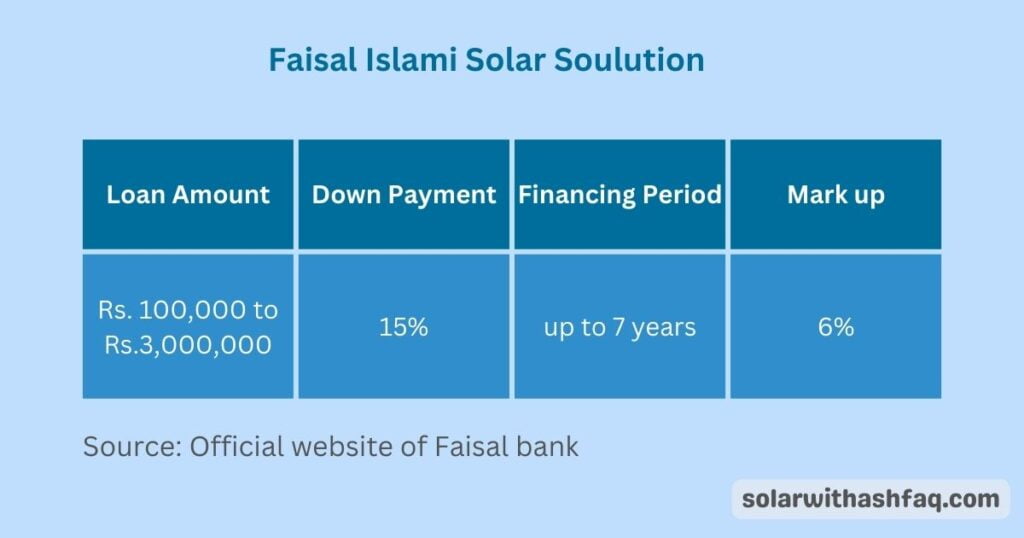

Faisal Bank Solar Financing

Faisal financing features

Like Meezan bank, Faisal bank financing is Shariah-compliant, and the whole process is hassle-free with minimum documentation.

Eligibility Criteria:

(For Salaried Individual)

- Minimum monthly gross salary PKR 100,000

- Age should be between 21 years to 60 Years

(For Self-Employed)

- Minimum monthly gross income PKR 150,000

- Age should be between 21 years to 60 Years

How to apply?

- SMS “ISS” space “City Name” space “CNIC” at 9181

- Bank official will call you to visit a nearby branch

- Submit the application form, which is available on the bank website.

- Provide the latest electricity bill

- Copy of applicant CNIC

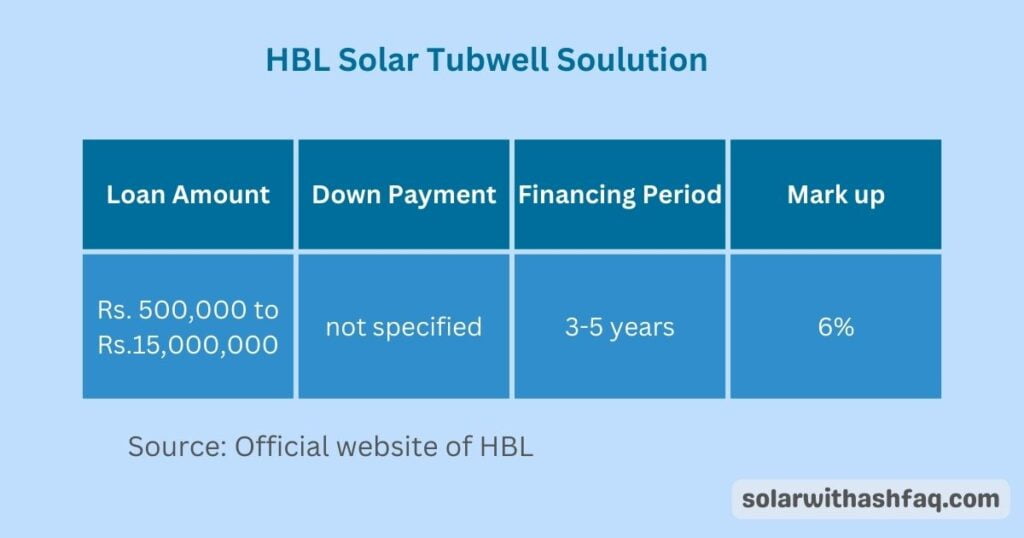

HBL Solar Financing

HBL financing features

If you want to install solar panels for tubewells, HBL is the best option.

As it offers quarterly and bi-annual installment plans, which suit most farmers.

Eligibility criteria

- The applicant must be the holder of a valid CNIC

- The borrower must be a farmer and cultivating his land

- The applicant should be 18-75 years of age

- Any other eligibility criteria applicable to the borrower

- Borrower should not be defaulter of any financial institution

How to apply?

- Original CNIC, along with an attested copy

- Two recent passport-size photographs of the applicant

- Proof of cultivation- Khasra Gardawari

- Additional documents to be applicable for leased land

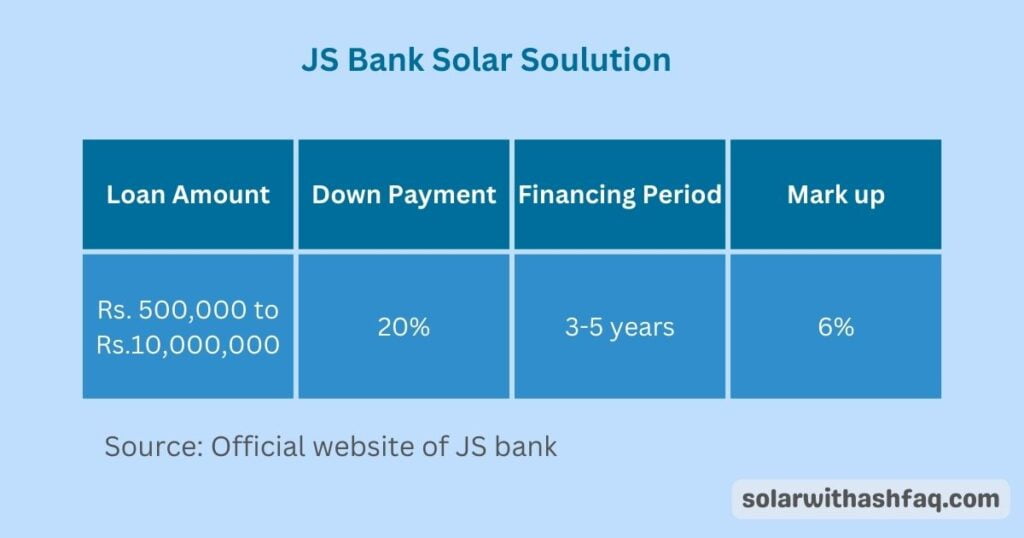

JS Bank Solar Financing

JS financing features

JS Bank offers financing options for installing solar panels on residential and commercial properties with a maximum range of amounts.

Eligibility criteria

- The applicant should be a Pakistani national

- Operating business for at least one year

- Proof of ownership of premises for solar installation should be provided.

- In case the property is not owned, NOC from the owner would be required

- Satisfactory credit history of existing bank

How to apply?

- Visit the bank and submit the application form

- Provide the latest electricity bill

- Attach ownership documents of the house/business

- Attach two copies of CNIC

Punjab Government Scheme for Free Solar Panels

As a Pakistani, you’ll be excited to know about the Roshan Gharana Program 2024 – a new government initiative that provides free solar panel kits to qualifying residents.

This is big news (also most awaited), as many countries worldwide are offering their own incentives to encourage the adoption of renewable energy, like the solar tax credits in the U.S. and India’s PM Surya Ghar: Muft Bijli Yojana scheme.

Under the Roshan Gharana Program, the Punjab government will distribute 50,000 solar panel kits with a total budget of Rs 12.6 billion.

To be eligible, you must be a Pakistani citizen

- With a valid CNIC,

- Own your home or have authorization from the property owner

- and consume less than 100 units of electricity per month.

The application process is user-friendly, with the government providing a dedicated cell in Punjab bank.

To apply, download this application form and submit it to the nearby branch of Punjab Bank.

Which Bank Should You Choose for Solar Financing?

Well, considering the above points, you are the best person to choose a bank that suits your needs, as solar is not a fit-for-all product.

I’d recommend contacting your current bank and asking about interest rates and repayment terms. The bank you already know and trust is likely the best place to go.

If I had to pen down my personal experience, Meezan Bank would be a great choice if you’re looking for a solar loan with a low down payment and flexible eligibility criteria.

As a Shariah-compliant bank, they offer financing through a Diminishing Musharakah structure. This means you and the bank jointly purchase the solar system, and you gradually increase your ownership over time as you make your monthly payments.

Similarly, if you are a farmer and want to reduce high bills by installing solar panels, then the HBL tubewell solar scheme is most suitable for you

On the other hand, Faisal Bank is a good option if you’re seeking a commercial solar loan. They have minimal conditions, and it’s relatively easy to get approval. Like Meezan, Faisal Bank also provides Shariah-compliant Diminishing Musharakah financing for your solar investment.

Pros and Cons of Choosing Solar Loans

Solar loan is suitable because

- If you don’t have enough money in hand but want to install solar, you can.

- Given the rising electricity costs, you will save significantly in the long run, including all bank charges.

- Different banks provide tailored solutions compliant with Sharia so that you can choose the best one for yourself.

Solar loan is not suitable because

- The overall cost for solar will be higher due to bank interest and processing fees.

- Monthly installments may change if the bank adjusts markup rates.

- Defaulting on monthly installments may result in late charges.

Solar Leasing

Besides taking loans from commercial banks, there are other options for using solar energy, one of them is solar leasing.

Under a solar lease agreement, a third-party company installs, maintains, and owns the solar panels on your property. As the lessee, you pay a fixed monthly fee for the use of the solar system.

Pak Renewable Energy and Alpha Solar are the leading names in Pakistan that provide solar leasing.

Benefits of solar leasing

- No upfront costs: The most significant advantage of a solar lease is that it eliminates the need for a large initial investment.

- Maintenance included: The leasing company is responsible for maintaining and repairing the solar system, so you don’t have to worry about additional costs or technical issues.

- Predictable Payments: You know exactly how much you will pay each month, which can help with financial planning.

Solar Fact

Solar leasing and power purchase agreements (PPAs) are not very popular in Pakistan because the solar industry is in its early stages. However, as more and more people install solar energy, these options are expected to become more popular in the near future.

Power Purchase Agreement (PPA)

A Power Purchase Agreement (PPA) is another excellent option without significant upfront costs.

In a PPA, a third-party developer installs, owns, and maintains the solar system on your property. Instead of paying a fixed lease fee, you agree to purchase the electricity generated by the system at a predetermined rate

Reon Energy is a trusted company for power purchase agreements. Recently, they installed a 1.86 MW solar farm at P&G Pakistan’s manufacturing site at Port Qasim.

Benefits of PPA

- No upfront costs: Similar to solar leases, PPAs eliminate the need for a large initial investment.

- Pay for what you use: With a PPA, you pay only for the electricity the system generates. This means your payments are directly tied to your energy consumption

- Maintenance included: The PPA provider handles all maintenance and repairs, ensuring that the system operates efficiently.

Final Thoughts

We have thoroughly covered all the solar financing options available in Pakistan, providing a balanced understanding of their advantages and disadvantages.

With this information, you can assess your needs and determine the most suitable option for you.

Frequently Asked Questions

Several banks providing solar financing in Pakistan include Meezan Bank, Allied Bank, Bank Alfalah, Faysal Bank, JS Bank, United Bank Limited (UBL), and Habib Bank Limited (HBL).

Options include low-interest loans from banks like JS Bank, Meezan Bank, and Sympl Energy, which provide up to 10 years of repayment terms. Eligibility typically requires proof of income, property ownership, and a valid CNIC.

The interest rate for Meezan Bank solar financing in Pakistan is fixed at 6% per annum. This competitive rate makes solar financing with Meezan Bank an attractive option for individuals.

Meezan Bank offers an interest-free solar financing program for homeowners in Pakistan. This program allows individuals to install solar panels on their properties without incurring any interest charges, making it a cost-effective and Sharia-compliant financing option.

You can get a solar system in installments in Karachi through banks like Bank Alfalah and JS Bank, which offer financing options with a maximum markup rate of 6% per annum. The repayment period can extend up to five years, with a down payment requirement of 20-25%.

Content Writer | Assistant Manager (Electrical) at IESCO

As a passionate content writer, I’m on a mission to make solar hassle-free for you through my expert guides and easy-to-digest content.